Waermondt [True Mouth]: You offer me a lot and I do not know whether I dare accept. I fear once I start, I will want to go on with it, again and again. And as one wave drives on another, so one deal would bring forth the other, and so, methinks, it is better I stay with my poor business and my own profession. I make no great profit and suffer no great loss.

Gaergoedt [Greedy Goods]: That's well said. But could you not venture a little? You give no money till it's summer and then you have sold all your stuff; or if you have any on hand you plant it and it brings still more profit.

Waermondt: It is well for those who have enough money, but for me I do not find it good advice. For if I have a penny, I must put it into my business.

Gaergoedt: You can barely earn ten per cent on the money that is in your business, and even then only by giving a caution, but with Flora it is cent for cent. Yes, ten for one, a hundred for one, and sometimes a thousand.

Waermondt: Vainly have I done such hard labor, and have many parents slaved and toiled. What need is there for merchants to have any style, or to risk their goods overseas, for the children to learn a trade, for the peasants to sow and to work so hard on the soil, for the skipper to sail on the terrible and dangerous seas, for the soldier to risk his life for so little gain, if one can make profits of this sort?

First Dialogue between Waermondt and Gaergoedt on the Rise and Decline of Flora (1637)

Traditionally in Holland, the buying and selling of tulip bulbs occurred during the summer, after the flower had bloomed in June and the bulb was lifted from the soil, to be wrapped in paper and kept dry indoors before being replanted in October, where it remained in the ground through the winter until the next flowering season. These months were the "dry bulb time," when the connoisseur (liefhebber) first viewed the blossoming flower and, after the leaves had yellowed and withered during senescence some weeks later, inspected the bulb. Payment was made, delivery taken and, by the beginning of autumn, it was in the tulip bed of the new owner.

By about 1634, however, there was a fundamental shift in how bulbs were traded. They now were sold by weight while still in the ground, with only a promissory note to indicate details of the bulb, including its weight at planting and when it would be lifted. The bulbs themselves, the delivery of which was months away, were not sold—only these paper promises. Weight was measured in asen (azen), an exceedingly small unit specific to tulips and equal to about one-twentieth of a gram or 0.00176 (1/568) of an ounce. Paying by weight was a fairer way to assess price, a smaller immature bulb costing less than a mature one, but it also increased the price of the heavier bulb.

And heavier bulbs tended to have more offsets or bulblets formed at the base of the mother bulb, which were separated and sold individually. A tulip bulb may produce two or three offsets a year and then only for several years before it becomes too enervated to reproduce. Propagating from these offsets, which can take from one to three years to become flowering bulbs themselves, necessarily limited the number of bulbs on the market. But, unlike seeds (which can take from seven to twelve years to blossom), it was the only way to ensure that the tulips would be genetically identical. A bulb with offsets obviously had greater value but it could not be sold too soon. To do so would limit the ability of the grower to produce any more of that variety and only make it available to other, potential rivals—which is why prized bulbs always were in short supply and commanded such high prices.

Because a bulb planted in October likely would weigh substantially more when lifted the following June, it encouraged speculation in the interim. Even if the price per aes did not change, the value of the bulb could multiply three to five times during those eight or so months, if only because of its increased weight. Contracting to pay a specified price at lifting, buyers speculated that the bulbs would have greater value in the future than the promissory note, which then could be sold to a new buyer in hope of realizing a profit. No longer the province of liefhebbers, bulbs began to be purchased by the weaver, brewer, or baker. For a modest investment, often paid for in kind (when there was not the cash), these poorer craftsmen and artisans speculated in the common varieties (vodderij or "rags") that were the stock of mass trade. Such speculation was risky, of course. Having put everything down on deposit, if the price of tulip bulbs were to drop before lifting, there would not be the means to pay the remaining balance. Nevertheless, novices continued to enter the market and speculation increased until, between December 1636 and January 1637, it reached its height.

So-called "piece goods," the varieties that were sold individually by weight, doubled or trebled in value. Even the most plain and common tulips, which previously had been disdained, were bought. These "pound goods," which were sold in bulk, rose as much as twenty-fold. Bulbs could be purchased by the pound (about 10,000 asen or approximately 30-60 bulbs), or in lots of 1,000 or 500 asen. Transactions no longer took place during the summer months but throughout the year. Nor did they involve the exchange of goods but became purely speculative, a windhandel or "wind trade," with only a promise to pay. As Gaergoedt declares, "Everything was worth money and so current that one could get in exchange almost anything one desired. And all this with promises and vouchers, when the bulbs were in the earth."

Even if buyers did not have the cash to purchase bulbs or sellers actually possess them, there still was the expectation that each succeeding sale would be for an ever higher amount. Some must have begun to wonder if escalating prices could be sustained and aware, too, that increased supply eventually would reduce demand. Ominously, Waermondt relates that a sale of tulips at Haarlem on February 3 had failed to attract any buyers, bringing everything to a standstill the next day. It may have been only hearsay, as he admits, because at Alkmaar about twenty miles to the north, the highest prices ever paid for many varieties were realized at an auction on February 5, 1637.

For several more days, pound lots of Switsers, a popular but common Bizarden named after the red and yellow coats of Swiss mercenaries, continued to sell at inflated prices. Goldgar notes that they went from 125 guilders (abbreviated fl.) per pound on December 31, 1636 to 1,500 fl. on February 1, 1637, a twelve-fold increase in just one month. And Gaergoedt recounts that Switsers that had come onto the market for 60 fl. later sold for 1,800 fl., ruefully lamenting that so much money has been spent for flowers that once had been weeded and thrown by the basketful onto the dung heap. "They are not a necessity and should only be paid for from the superfluous." It was this belated realization that marked the end of tulipmania. Two days after the auction at Alkmaar, the market crashed and traders (bloemisten) anxiously met to discuss what should be done.

In a trade in which the grower promised delivery of tulips in the ground and the purchaser to pay upon receipt, trust and honor were important, especially since the blossom seen in June need not necessarily look the same the following year. Buyers no doubt worried about the quality of the bulb and sellers, being paid in full or at all—which is why such transactions often were written down and signed, the buyer (as Gaergoedt recounts in the Second Dialogue) pledging to "engage all my goods, movable and immovable" to guarantee the purchase.

When prices were high, it had been the seller who was tempted to withhold delivery in hope of a better offer. Now it was the buyer who might renege on a promise to pay or attend the lifting, which was the only way to verify that the bulb was the one contracted. Finally meeting in Amsterdam on February 23, 1637, bloemisten proposed the next day that the sale of tulips on or before November 30, 1636 remain binding. Transactions after that date, when the market had become increasingly speculative, could be rescinded if a penalty of 10% of the purchase price was paid. For the scheme to work, however, each buyer would have to compensate the one before him until possession of the bulb (or rather the promissory note to purchase it) finally reverted to its original owner, who would receive a tenth of its original sales price and be free to sell it again. Only ten guilders might be repaid for every hundred, or a hundred for every thousand, as Waermondt observes in the Second Dialogue, but "the money which has been promised cannot be found." Nor was the proposal practical. Suppose, he explains, a bulb that sold for 30 fl. was then resold for 60 fl. and again for 100 fl. and finally for 200 fl. If the last person to own the bulb did not wish to keep it, he was to pay 10% (20 fl.) of its price in compensation to the man who had sold it to him. If that person no longer wanted the bulb, he too would pay a 10% penalty (10 fl.) and so on, until the bulb eventually returned to the grower, who would be compensated 3 fl. "What a commotion!" comments Gaergoedt, to which Waermondt retorts: "A brainless commerce, as I said, and against all good business ways." Ostensibly, the agreement was "to prevent the damage, yes, the extreme ruin which some, more especially the new amateurs, are to expect." No doubt, too, the bloemisten wanted to recover some of their money. But those from Amsterdam did not adopt the proposal and several others did so only conditionally, refusing to accept such potential losses and aware of the difficulty in collecting their money when any break in the chain of buyers would make it impossible.

"There have been so many transactions, and so many by insolvent people," as Gaergoedt recognized. And it supposedly was for their benefit that the burgomaster and governors of Haarlem (the center of the tulip trade) resolved on March 7 that any trade in flowers since the last planting be nullified altogether. Increasingly vexed by the intractability of the problem and the refusal to take delivery of devalued bulbs, the matter eventually was referred to the provincial court at The Hague which, in a resolution of April 27, felt that it would be better if it first received "further information concerning the origin and the time of the successive great increases in the sale of tulips, as well as concerning the great decline in prices." Moreover, this could be done most conveniently by the town magistrates, who were advised to bring growers and florists together and have them resolve matters amicably among themselves. In the meantime, contracts, although binding, were not to be officially enforced. Sellers should get what they could for their unclaimed bulbs, which soon would begin to blossom, and recover any difference in price from the buyer. The court itself wanted no part in adjudicating such cases or having the judicial system filled with lawsuits. Nor did the various municipalities. As one lawyer declared in frustration at this dithering, "And not only no justice was administered, but all notaries, solicitors, and ushers were forbidden by the authorities: the notaries were not to summon, the solicitors not to make plaints, and the ushers not to bring them and not to occupy themselves with these matters." The result was that many buyers were unwilling to compromise and those who did paid only "one, two, three, four, yes, even five, which was the utmost, out of a hundred [guilders]," which is to say only 5% or less of the purchase price.

Finally, almost a year later on January 30, 1638, a commission was established in Haarlem to arbitrate any remaining disputes, its decisions given the force of law on May 28. Contracts could be terminated with a payment of 3.5% "grieving money" (rouwkoop), the fine that typically was charged to compensate the seller and excuse the buyer when a transaction was canceled. Intended to maintain the honor of those involved, the resolution was not completely satisfactory to either party. Sellers were obliged to keep their bulbs but did recover some of their original cost. And buyers, who would have preferred to pay nothing at all for them, met their legal obligation by offering rouwkoop (although they often returned to court, refusing to accept even that modest penalty).

It should be remembered that the extraordinary prices quoted at the Alkmaar auction were not paid at the time. Nor was delivery taken or the bulbs available for inspection, as they had been in the ground since the previous September and would not be lifted until June, when they were to be delivered and payment made. The trade, too, largely was an urban phenomenon that involved a relatively small segment of the population, typically liefhebbers and merchants (especially those in the textile industry) and later, master craftsmen and artisans. Goldgar identifies only thirty-seven people who spent more than 400 fl. on bulbs, nearly all of whom comprised a coterie of wealthy burghers who readily expended more on other pursuits and often dealt only with their own social class. It was a closed society connected by family, religion (many were Mennonites), and the neighborhood in which they lived—which should have facilitated the amicable resolution hoped for by the provincial court—but very often did not.

Unless sellers who still held bulbs had been imprudent enough to have bought other goods on credit in expectation of later profits, losses often were notional only. Financial difficulties are recorded during this time—especially among the poor, whose plight was less likely to be remarked upon and so is not known. But Goldgar found few, if any, actual bankruptcies that could be attributed to tulipmania alone. To be sure, the influential landscape painter Jan van Goyen had invested in tulips just days before the crash, agreeing to pay almost 1,800 fl. and two of his paintings for forty tulip bulbs. He died impoverished twenty years later, relentlessly hounded to pay his debts. But his ongoing speculation in land and property no doubt contributed to his bankruptcy. Nor was the national economy significantly affected; indeed, it would continue to grow through the mid-seventeenth century.

The value of tulip bulbs initially was established by the liefhebbers who could afford to buy and sell them. The mania, which seems so irrational now (as it had been to moralists at the time), was the foolish belief that speculation could continue indefinitely and that ever increasing amounts would be paid for such a luxurious and perishable commodity. When the market inevitably crashed and contracts were dishonored and debts not repaid, the social norms and civic harmony of Dutch society were called into question. Particularly in a mercantile economy, what was to be done when honorable men betrayed their trust? For Gaergoedt, a weaver who had mortgaged his house and sold his loom to buy more bulbs, as well as for his contemporaries, the only explanation was that "it has been a madness."

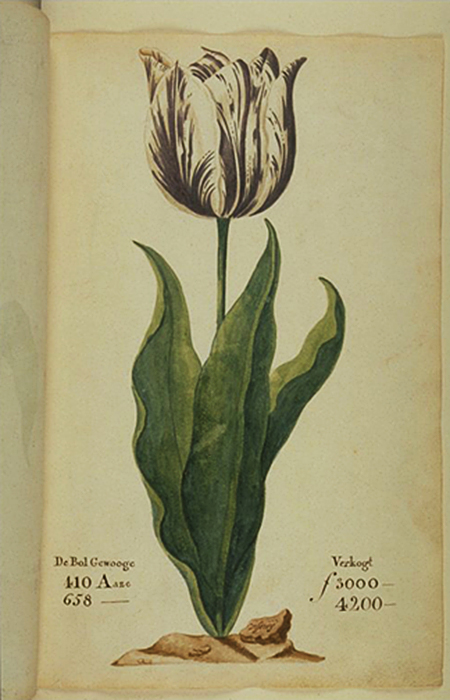

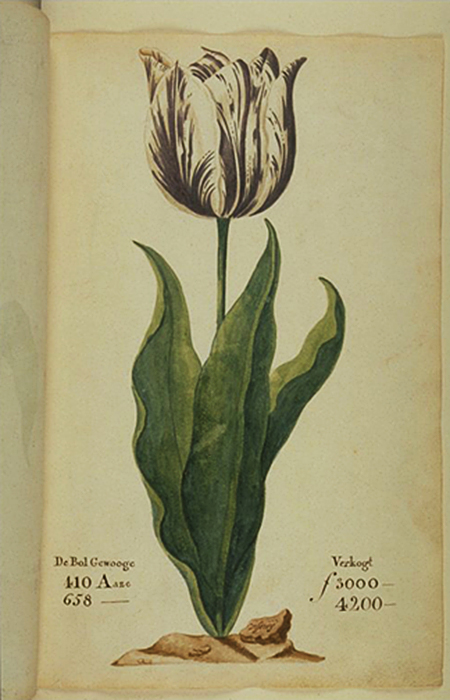

A "tulip book" was a catalog of tulips in watercolor and gouache (opaque watercolor) commissioned by a florist (bulb dealer) to illustrate to prospective buyers what they might expect to see when the flower bloomed the following spring. The nursery catalog of the Haarlem florist P. Cos (1637) is unique among such books in that it mentions the name, weight, and price of the bulbs sold at the time. The most expensive was the Viseroij (Viceroy), the Violetten illustrated above that sold for 3,000 guilders (and another heavier one for 4,200). Even the lower price was twenty times the annual salary of a skilled craftsman.

This detail of a Viceroy is by Pieter Holsteyn the Younger (1614-1673), who himself illustrated a tulip book, likely in the mid-1640s.

As exceptional as was the Viceroy, higher prices still were offered for another variegated break—Semper Augustus, a Rozen that was the most celebrated of all tulips in seventeenth-century Holland.

Clare Ontdeckingh der Dwaesheydt, a pamphlet published in 1636, provides an itemized list of what 3,000 guilders would have purchased at the time: two lasts of wheat, four lasts of rye, four fat oxen, eight fat pigs, twelve fat sheep, two hogsheads of wine, four tuns of beer, two tuns of butter, a thousand pounds of cheese, a bed with fine furnishings, a suit of clothes, and a silver beaker—and to bring the total to 3,000 guilders, a ship for 500 fl. more to transport everything. All this for a bulb that weighed 410 asen or about seven-tenths of an ounce. (The 67 bulbs described at the Alkmaar auction averaged 283 asen; by comparison, a tulip bulb from a California grower weighs approximately 20-23 grams, or about 448 asen.)

A "last" approximated 82.5 bushels of grain, each equal to 64 pints. An oxhoofd ("oxhead'), which was corrupted in English to hogshead, held about 60.7 gallons. And a "tonne" or tun, another liquid measure, equaled about 41.5 gallons. (These equivalences are taken from the New Netherland Institute's "Guide to Seventeenth Century Dutch Coins, Weights and Measures.")

Hirschey calculated the bulb's valuation in 1998 to be $34,584, although he mistakenly assumed that these goods actually were received in trade. In gold, the equivalent value would be much higher. A florin had a gold content of 0.77 grams (0.027 ounces) in 1638. Evaluating gold at $1,200 per ounce, this would have been equal to $97,200. Another index is provided by the International Institute of Social History (Amsterdam), which calculates that 3,000 fl. would have had the purchasing power in 2013 of $41,676 (after converting euros to dollars).

The Judith Leyster tulip book in the Frans Hals Museum (Haarlem) is named after the only woman to have earned her living as an artist at the time. A probable student of Frans Hals, she painted two Rozen tulips for the book named after her, one of which is illustrated above.

Tulipmania occurred at the same time that bubonic plague was ravaging the Netherlands, a fifth of the population dying in Amsterdam in 1635-1636, Haarlem losing about that many in 1635 alone. The Thirty Years War (1618-1648) between Catholic Spain and the Protestant North also was being waged, and a major defeat of the Swedes in September 1634 allowed more military resources to be directed against the Dutch. And a Swedish victory in October 1636 may have reduced demand for tulips by the Germans, whose nobility favored the flower.

Disease, death, and despair no doubt encouraged the risky speculation in tulip bulbs. With a reduced work force, wages would have risen and workers, who otherwise would not have had the money, may have been able to speculate in tulips for the first time. A certain fatalism, too, may have encouraged such reckless behavior—or its opposite, exultation simply in having survived.

"The commissioners in the matter of flower trade announce that they have resolved, in the contracts of the aforesaid trade, which are of their concern, and where the decision remains with them, to agree on 3 1/2 per cent consolation money."

Resolution of Burgomaster and Governor of Haarlem, May 22, 1638

Thompson dismisses tulipmania, regarding it "an artifact created by an implicit conversion of ordinary futures contracts in a largely failed attempt by several Dutch burgomasters to bail themselves out of previously incurred speculative losses in the normal, fundamentally driven, market for Dutch tulip futures." The resolution above, in other words, promulgated almost sixteen months after the crash on February 5, 1637, effectively converted what Thompson understands (in modern financial terms) to be futures contracts into option contracts. Themselves heavily invested in tulip speculation and at risk of onerous financial loss, the burgomasters, he contends, relieved themselves of the obligation to honor their futures contracts by compensating the seller instead with a 3.5% call option (i.e., the option to buy an asset at an agreed price or by a particular date). On the assumption that the burgomasters would not have bought futures contracts if they had known that prices would collapse, they simply changed the nature of the contract. And it was this change that prompted the run-up in prices. Speculators could contract to purchase tulips in the future and, if they increased in price by then, a profit was made; if prices fell in the interim, the contract could be voided with only a small fee. "As the information of the Burgomasters' deliberations and plans entered the market in late November, contract prices soared to reflect the expectation that the contract price was now a call-option exercise, or strike, price if the future spot price [the price paid for immediate delivery] turned out to be less than the contract price." Rather than a mania, the trade in tulips was no more than a rational response to an efficient market.

The resolution was the ratification of the earlier agreement of February 24, 1637, in which growers had declared, in Thompson's words, "that all futures contracts written after November 30, 1636 and before the re-opening of the cash market in the early Spring, were to be interpreted as option contracts." It is difficult to understand how this informal proposal, which was not accepted by the bloemisten in Amsterdam and only conditionally by others nor adopted by the authorities, could have precipitated—more than a year later—the crisis it was intended to resolve or that this conversion could somehow have been intuited by December 1, 1636. As to Thompson's contention that "the more informed Burgomasters were able to escape the hook," only two of the fifty-four regents who governed Haarlem in 1636 and 1637 were involved in the tulip trade.

Garber, too, seeks to defend the working of a capitalistic market and concludes that the trade in tulips "reflects normal pricing behavior in bulb markets and cannot be interpreted as evidence of market irrationality." But if market fundamentals might explain an increase in the price of a Semper Augustus, they do not for Switsers, trade in which Garber dismisses as "little more than a mid-winter diversion among tavern regulars mimicking more serious traders." Insofar as a "bubble" is speculative trade in an asset valued far above its intrinsic worth that is followed by a sharp decline, the speculation in Switsers would seem to meet that definition. At the beginning of January 1637, the value of the bulb was negligible, little more than weeds. More precisely, a Haarlem pound (9728 asen) sold for 125 fl. or about 0.01 fl. per aes. On January 22, an Amsterdam pound (10,240 asen) sold for 0.03 fl per aes. Just ten days later, Switsers were selling for 0.15 fl. per aes—or more than 0.18 if Gaergoedt is to be believed. A bulb weighing 283 asen would cost 51 f1., almost twenty times its original price.

Montias demonstrates the perhaps not surprising affinity between artists, dealers in their work, and those who bought and sold tulip bulbs—both as a matter of taste and in their attitude toward risk. There is only one surviving record of an auction of tulip bulbs in Amsterdam. In 1625, the Orphan Chamber disposed of bulbs in which two thirds of the buyers also purchased works of art at other such auctions. That year, too, 1,200 guilders was asked for a single Semper Augustus bulb, although it is not known whether the price actually was paid. At another auction in 1633, for which the record has been lost, two bulbs were sold, one for 50 fl and another for 41 fl, the buyer later complaining that they were not, in fact, the variety promised. This same florist later is said to have sold tulips worth 20,000 fl. in a single year, spending half that amount on a fine manor house and investing the rest in more bulbs—boasting that he once spent 1,200 fl. on one bulb alone

The Dialogues between Waermondt and Gaergoedt are three anonymous pamphlets printed (and likely written) by Adriaen Roman in Haarlem between February and May, 1637 that satirized the folly of tulip mania of 1634–1637. Although moralizing, the Samen-Spraeck tusschen Waermondt ende Gaergoedt is the most important primary source for the period. In 2016, a copy of the twenty-four page pamphlet sold at auction for £10,625.

References: Tulipomania (1999) by Mike Dash; The Tulip (1999) by Anna Pavord; "Famous First Bubbles" (1990) by Peter M. Garber, The Journal of Economic Perspectives, 4(2), 35-54; "Tulipmania" (1989) by Peter M. Garber, The Journal of Political Economy, 97(3), 535-560 (this article derives from an earlier monograph by Garber, "The Tulipmania Legend" [1986] published by the Center for the Study of Futures Markets, Columbia University, Working Paper Series, CSFM-139); "The Tulip Mania in Holland in the Years 1636 and 1637" (1929) by N. W. Posthumus, Journal of Economic and Business History, 1, 434-466 (the stock market crashed late in October that year; the translation of the Dialogues are taken from this article); Tulipomania (1950) by Wilfrid Blunt; The Embarrassment of Riches (1987) by Simon Schama; Tulipmania: Money, Honor, and Knowledge in the Dutch Golden Age (2007) by Anne Goldgar; The Dutch Tulip Mania: The Social Foundation of a Financial Bubble (2012) by A. Maurits van der Veen; Tulips Portrayed: The Tulip Trade in Holland in the 17th Century (1992) by Sam Segal; Tulipmania: Fact or Artifact (2002) by Earl A. Thompson and Jonathan Treussard; Memoirs of Extraordinary Popular Delusions (1841) by Charles Mackay (Vol. 1, pp. 85-92)—plagiarized from A History of Inventions, Discoveries, and Origins (1782-) by Johann Beckmann, translated by William Johnston from 1797-1814; Clare Ontdeckingh der Dwaesheydt (1636) Anonymous (cited by Munting, 1671, p. 632; 1696, p. 907); "Verzameling van een meenigte tulipaanen (1637) by P. Cos (Krelage Collection, Wageningen University Library, Netherlands); Waare Oeffening der Planten (1671) by Abraham Munting; Naauwkeurige Beschryving der Aadgewassen (Vol. 2, 1696) by Abraham Munting; "How Much is a Tulip Worth?" (1998) by Mark Hirschey, Financial Analysts Journal, 54(4), 11-17. Other important references are in Dutch, including Posthumus, De Speculatie in Tulpen in de Jaren 1636 en 1637 (1926, 1927, 1934) and De Pamfletten van de Tulpenwindhandel, 1636-1637 (1942), and Bloemenspeculatie in Nederland, De Tulpomanie van 1636-1637 en de Hyacintenhandel 1720-'36 (1942) by E. H. Krelage; Art at Auction in 17th Century Amsterdam (2002) by John Michael Montias; Great Bubbles: Reactions to the South Sea Bubble, the Mississippi Scheme and the Tulip Mania Affair, Vol. I (2000) edited by Ross B. Emmett (which also translates the Dialogues).

Beckmann says (p. 25) that the word "tulipomania" was coined by Gilles Ménage in his Dictionnaire Etymologique de la Langue Françoise (1750), Vol. 1, p. 593. Rather, the word seems to appears in Vol. 2, p. 555 and earlier still in his Dictionnaire Etymologique ov Origines de la Langue Françoise (1694) , p. 707—tant la Tulipomanie étoit grande, "so great was the tulipomania."

![]()